The earlier week was diminished to only a quick 3-day buying and selling week as Monday was declared a particular vacation whereas on Friday, the markets remained shut on account of Republic Day. Regardless of this, the markets remained extraordinarily uneven and traded in a a lot wider vary as they continued to say no for the second week in a row. The week-on-week change might look regular however throughout these three days, the Nifty witnessed wide-ranging strikes with spikes in volatility. Throughout the previous three periods, the index oscillated in a large 613.05 factors vary. Whereas persevering with to retrace, the headline index closed with a web lack of 269.80 factors (-1.25%).

As we step into the brand new week, the markets face probably the most vital exterior home occasions, i.e., the Union Finances slated to be offered on the first of February. Nevertheless, you will need to perceive and be aware that as a consequence of Normal Elections scheduled later this yr, the Authorities won’t current a full-fledged Union Finances however a “Vote-on-Account”. As soon as the elections are accomplished away with, the Authorities often comes up once more with a full finances. Regardless of this technicality, the markets will proceed to react in a really unstable approach. The volatility can be much more as the first falls on Thursday which can also be a weekly choices expiry day for Nifty. Total, going by the F&O information, the markets have dragged their resistance ranges decrease to 21700; as long as the Nifty is beneath this level, no runaway rallies are anticipated.

Additional to this, there are robust prospects that the markets stay uneven all through this week; a pointy directional bias is predicted to emerge post-Thursday as soon as the exterior occasion of Vote-on-Account is out of the best way. The approaching week is more likely to see the degrees of 21500 and 25750 performing as resistance whereas helps are anticipated to come back in at 21100 and 20950 ranges. The buying and selling vary is predicted to remain wider than normal.

The weekly RSI stands at 65.78; it has crossed below 70 from the overbought space which is bearish. It stays impartial and doesn’t present any divergence in opposition to the value. The weekly MACD stays bullish and above its sign line.

The sample evaluation on the weekly chart reveals that following a breakout from a rising channel from 20800 ranges, NIFTY went on to kind a excessive level at 22124. Subsequently, it has seen a retracement and the closest sample help rests close to 20900-21000 within the type of the pattern line of the rising channel which it crossed earlier. This prior resistance is now anticipated to be the closest sample help for the markets.

Over the approaching days, it’s strongly beneficial to keep away from extremely leveraged exposures within the markets because the volatility is predicted to spike as we go close to the occasion day. This may occasionally trigger sharp strikes by the markets on both aspect; the cease losses on both aspect are more likely to get triggered incessantly. However, we are going to see defensive pockets like IT, Pharma, and so forth., doing properly. Additionally it is anticipated that the Metallic shares typically and PSE shares, specifically, might do properly in the course of the run-up to the occasion. It’s strongly beneficial to undertake a extremely selective strategy to the markets. Whereas staying stock-specific whereas making new purchases, the exposures must also be saved at modest ranges.

Sector Evaluation for the approaching week

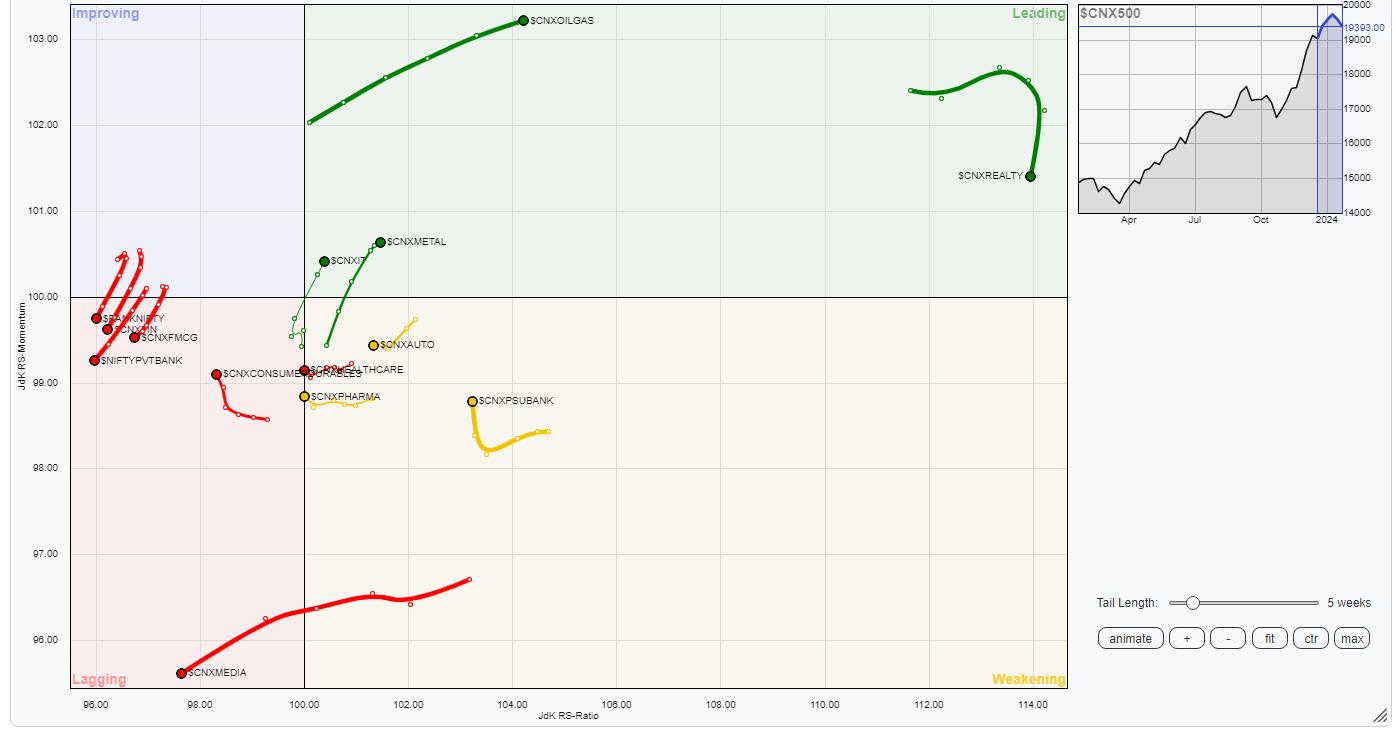

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) Nifty Metallic, Infrastructure, PSE, Commodities, and Vitality Sectors are positioned contained in the main quadrant. These sectors are joined by the IT Index which has additionally rolled contained in the main quadrant. Collectively, these teams will comparatively outperform the broader markets. The Realty Index can also be contained in the main quadrant; nonetheless, it’s seen slowing down and giving up on its relative momentum.

The Midcap 100, Auto, and Pharma teams are contained in the weakening quadrant. The PSU Financial institution Index can also be contained in the weakening quadrant however it’s seen sharply bettering on its relative momentum in opposition to the broader markets.

The Media Index continues to languish contained in the lagging quadrant. The Nifty Financial institution index has additionally rolled contained in the lagging quadrant. These teams, together with Nifty Monetary Providers, FMCG, and Consumption that are additionally contained in the lagging quadrant are anticipated to comparatively underperform the broader Nifty 500 index.

The Nifty Providers Sector index is the one one contained in the bettering quadrant; nonetheless, it additionally seems to be giving up on its relative momentum.

Necessary Notice: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, at the moment in its 18th yr of publication.