On January 14, 2019, the Singapore Parliament handed its complete Fee Companies Act (PS Act), changing the previous Fee Programs Oversight Act and Cash-Altering and Remittance Companies Act to broaden the scope of regulated cost actions to incorporate rising developments and industries like digital belongings and cryptocurrencies.

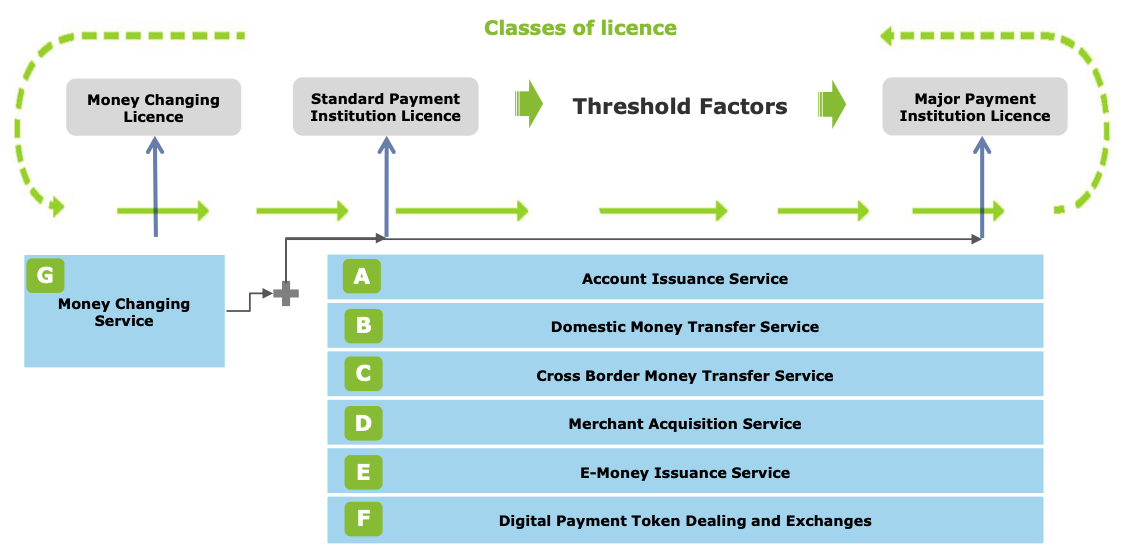

The laws, which goals to supply regulatory certainty and shopper safeguards about cost actions, all of the whereas encouraging innovation and development of cost companies and fintech, regulates seven companies: account issuance, home cash transfers, cross-border cash transfers, service provider acquisition companies, e-money issuance, money-changing, and so-called digital cost token (DPT) companies.

It additionally lays out a modular licensing framework comprising three completely different license courses. Every license permits the holder to conduct a number of particular cost companies.

The Cash-Altering License will allow companies to conduct money-changing companies; the Normal Fee Establishment License permits them to conduct a number of cost companies beneath specified thresholds, and the Main Fee Establishment License permits companies to conduct a number of cost companies with none transaction quantity or float limits.

Singapore’s Fee Companies Act licensing framework for cost service suppliers, Supply: Deloitte, 2019

For the reason that PS Act got here into impact on January 28, 2020, the Financial Authority of Singapore (MAS) has acquired over 580 functions for cost companies licenses and accomplished the evaluation of greater than half of them, MAS board member Alvin Tan stated on April 4, 2022.

He added that 87 functions had been accredited, 11 had been rejected, and 147 entities withdrew their functions. Round 179 entities remained exempted from licensing and are nonetheless awaiting regulatory evaluation.

Knowledge from MAS’ Monetary Establishments Listing present that as of August 01, 2022, 231 Cash-Altering, 13 Normal Fee Establishments, and 175 Main Fee Establishment licenses had been issued. Of those, solely ten corporations had been permitted to supply DPT companies.

As well as, desk analysis means that a minimum of 4 corporations have acquired in-principle approval for both a Normal or Main Fee Establishment license.

These figures recommend that regardless of early claims {that a} clear regulatory framework would supply a stable basis for Singapore to consolidate its place as Asia’s crypto hub and permit the nation to see the emergence of a thriving crypto sector, the foundations have weeded out an terrible lot of startups, amongst which Binance and Huobi.

Additional highlighting Singapore’s altering stance in the direction of crypto companies, a number of new guidelines have been launched this 12 months, which forbid DPT service suppliers to advertise their companies to most people and require crypto service suppliers within the city-state that solely do enterprise abroad to be licensed regardless.

In Could 2023, the MAS launched a Session Paper on amendments to the Fee Companies Rules 2019, introducing new measures for Digital Fee Token (DPT) companies, together with a requirement for buyer asset safekeeping beneath statutory belief.

The transfer goals to guard towards monetary crime and loss, significantly in digital fraud, and contains broadening DPT service definitions and enhancing Anti-Cash Laundering (AML) protocols reminiscent of Buyer Due Diligence and transaction monitoring.

Moreover, the MAS’s current proposals, efficient mid-2024, set stringent pointers for DPT service suppliers, specializing in conflict-of-interest administration, itemizing standards, grievance dealing with, and buyer threat consciousness.

Per FATF (Monetary Motion Process Drive) requirements, compliance with the Journey Rule mandates DPT companies to share consumer info for transactions, making certain additional security in digital transfers. Entities offering DPT companies earlier than 28 January 2020 are quickly exempted from licensing beneath particular situations.

Suppliers should segregate and defend buyer belongings beneath a statutory belief, making certain operational independence from different enterprise items, thereby decreasing asset loss dangers and facilitating asset restoration in insolvency instances.

In November 2023, MAS mandated that DPT service suppliers cease accepting bank card funds from native issuers, aiming to curb cryptocurrency hypothesis amongst retail shoppers. That is a part of MAS’s broader technique to strengthen shopper safeguards and mitigate dangers within the digital foreign money area.

Following its newest suggestions publication on DPT rules, MAS has launched guidelines specializing in enterprise conduct and expertise threat administration. These guidelines require DPT suppliers to handle conflicts of curiosity, preserve clear DPT itemizing insurance policies, and have sturdy buyer complaint-handling processes.

Extra measures embrace prohibiting buying and selling incentives and bank card funds, demanding an intensive evaluation of shoppers’ threat consciousness and web price, and limiting financing or leverage choices.

Singapore’s 13 licensed crypto companies suppliers

As of 24 January 2024, MAS had given the inexperienced mild to 13 crypto service suppliers. These entities comprise 11 Main Fee Establishment licensees and two Normal Fee Establishment licensees.

Eleven Main Fee Establishments permitted to supply DPT Companies

DBS Vickers Securities is a securities and derivatives brokerage agency owned by DBS that enables shoppers to put money into inventory exchanges, preliminary public choices (IPOs) and personal placements. It’s additionally the operator of the DBS Digital Trade, a supplier of member-only exchanges providing skilled traders with entry to digital belongings reminiscent of safety tokens and crypto.

Digital Treasures Middle (DTC) is an enterprise options supplier providing retailers on-line companies for accepting digital cost options, together with cost settlement, debit playing cards, digital wallets, and cryptocurrencies.

FOMO Pay gives a digital cost processing platform that enables retailers and monetary establishments in rising markets to just accept a full suite of cell funds, together with cryptocurrencies.

Impartial Reserve is a regulated crypto alternate serving over 200,000 clients in Australia, New Zealand, and Singapore.

Revolut is a digital financial institution from the UK that’s trying to introduce DPT companies in Singapore quickly, together with the power for native clients to purchase, promote, and maintain cryptocurrencies.

Sparrow Tech Personal gives digital asset merchandise and options. These embrace enabling PayNow transactions for institutional and high-net-worth shoppers who purchase and promote cryptocurrencies utilizing fiat on its buying and selling platform, in addition to working with monetary establishments and household places of work to design bespoke digital asset options.

Paxos is a New York-headquartered monetary establishment and expertise firm specialising in blockchain expertise. The corporate’s product choices embrace a cryptocurrency brokerage service, asset tokenisation companies, and settlement companies. Its subsidiary, Paxos Digital Singapore, has gained in-principle approval from MAS to supply digital cost token companies and is about to concern a USD-backed stablecoin, compliant with the nation’s proposed stablecoin regulatory framework.

Hako Expertise operates the Coinhako crypto alternate platform, which permits traders to purchase and promote cryptocurrencies utilizing numerous cost strategies together with financial institution transfers and bank cards.

MetaComp, previously generally known as Cyberdyne Tech Companies, will now be capable of provide an end-to-end suite of digital asset companies to corporates, in addition to conventional and crypto-native institutional traders.

Upbit, operated by Dunamu, is a digital asset alternate based mostly in South Korea, which is lively in Singapore, Indonesia, and Thailand. The platform helps cryptocurrency buying and selling, together with Bitcoin and Ethereum, and gives an online interface, cell functions, an NFT market, and staking companies.

Upbit, operated by Dunamu, is a digital asset alternate based mostly in South Korea, which is lively in Singapore, Indonesia, and Thailand. The platform helps cryptocurrency buying and selling, together with Bitcoin and Ethereum, and gives an online interface, cell functions, an NFT market, and staking companies.

Ripple operates a blockchain-based digital cost community and protocol, primarily recognised for its native cryptocurrency, XRP.

Two Normal Fee Establishments permitted to supply DPT Companies

BHOP Consulting runs BHex, a monetary decentralized digital asset buying and selling platform. The corporate gives crypto belongings, in addition to custody and clearing infrastructure companies.

Triple A Applied sciences gives a white-label crypto cost answer, serving e-commerce retailers, retailers, recreation suppliers, cost companies suppliers, fintech corporations, marketplaces and tech corporations.

No less than 9 crypto corporations have acquired in-principle approval

Crypto.com is a crypto alternate headquartered in Singapore that helps buying and selling, investing, staking, wallets, non-fungible tokens (NFTs), and extra. It claims 50 million clients.

Coinbase is a digital asset alternate firm initially headquartered in San Francisco, California, and has develop into a remote-first firm. They dealer exchanges of Bitcoin, Ethereum, Solana, and different digital belongings.

Coinbase is a digital asset alternate firm initially headquartered in San Francisco, California, and has develop into a remote-first firm. They dealer exchanges of Bitcoin, Ethereum, Solana, and different digital belongings.

Blockchain.com, previously generally known as Blockchain.data, is predicated in London, England. It has cryptocurrency buying and selling companies, a blockchain pockets for storing digital currencies, lending companies, and numerous information creation methods for the blockchain economic system.

Circle is a monetary expertise firm that makes use of blockchain expertise for its peer-to-peer funds and cryptocurrency-related merchandise, enabling companies and people to make use of digital foreign money. The corporate is headquartered in Boston, Massachusetts.

Sygnum is a digital asset expertise group with a Swiss banking license and a Singapore Capital Markets Companies (CMS) license.

Its services embrace a digital asset administration platform, a digital foreign money buying and selling platform, and a variety of different services.

BitGo Inc., based mostly in Palo Alto, California, gives regulated custody, lending, and infrastructure companies to over 1,500 institutional shoppers throughout 50 nations. The corporate additionally gives crypto training, immediate shopping for, staking, and investor safety options.

Moomoo permits investments in shares, ETFs, and American depositary receipts, with buying and selling choices within the US, Hong Kong, and China. The agency is operational within the US, Malaysia, and Australia.

Moomoo permits investments in shares, ETFs, and American depositary receipts, with buying and selling choices within the US, Hong Kong, and China. The agency is operational within the US, Malaysia, and Australia.

XREX Singapore, a blockchain-based fintech centered on cross-border funds, is getting ready to supply numerous cost companies, reminiscent of digital cost tokens. The corporate can be enhancing its BitCheck instrument to facilitate transactions involving fiat, stablecoins, and cryptocurrencies.

StraitsX gives digital asset cost infrastructure in Southeast Asia, issuing StraitsX SGD and StraitsX USD. These will develop into “MAS-regulated stablecoins” following legislative amendments.

Crypto companies that withdrew their license functions

Hodlnaut is a Singapore-based fintech startup that enables crypto traders to earn curiosity on their crypto holdings by lending them to vetted establishments.

Nevertheless, it has withdrawn its Main Fee Establishment License utility from MAS and halted withdrawals, token swaps, and deposits with rapid impact citing “market situations” as its purpose.

Hodlnaut and its administrators are at present being investigated by the police for potential dishonest and fraud offences.

Luno is a worldwide crypto alternate headquartered in London that serves over 10 million clients throughout greater than 40 nations.

Luno is a worldwide crypto alternate headquartered in London that serves over 10 million clients throughout greater than 40 nations.

In 2023, the corporate determined to halt its companies in Singapore, withdrawing its beforehand submitted license utility to the MAS and ceasing operations for its Singaporean clientele.

Genesis Buying and selling is a blockchain advisory and funding agency headquartered in Singapore referred to as Genesis Asia Pacific Pte. Ltd.

The corporate gives a single entry level for digital asset buying and selling, derivatives, borrowing, lending, custody, and prime brokerage companies.

Nevertheless, following the fallout from the FTX implosion, the agency halted withdrawals in its lending enterprise and subsequently filed for Chapter 11 chapter.

Regardless of these challenges, Genesis Asia Pacific, a Genesis Group subsidiary, has acquired in-principle approval to supply digital cost companies beneath Singapore’s Fee Companies Act 2019.

Regardless of this, the Financial Authority of Singapore (MAS) clarified that each Genesis Asia Pacific and Gemini Belief Firm, which holds an exemption from licensing, are at present unlicensed. MAS acknowledged that it’s going to think about all important developments throughout their licence utility assessments.

Featured picture credit score: Edited from Unsplash

Editor’s Observe: This text was final up to date on 25 January 2024 to mirror current modifications in licensing standing