EUR/USD: US Financial system Delivers Surprises

● The 2 most important occasions final week occurred on Thursday, January 25. On this present day, the European Central Financial institution (ECB) held a gathering, and preliminary GDP information for the US for This autumn 2023 was printed.

As anticipated, the ECB left the important thing rate of interest unchanged at 4.50%. The regulator additionally maintained different crucial parameters of its financial coverage. On the press convention following the assembly, ECB President Christine Lagarde shunned commenting on potential timelines for price cuts. She reiterated her earlier statements, noting that the ECB Governing Council members imagine it’s untimely to debate coverage easing. Nonetheless, Lagarde highlighted that wage development is already declining and added that they anticipate additional inflation discount all through 2024.

● General, the primary occasion handed with out surprises, not like the second. The preliminary GDP information for This autumn 2023 launched by the US Bureau of Financial Evaluation confirmed the anticipated slowdown in American financial development in comparison with the extraordinarily excessive charges of Q3 (4.9%), reaching 3.3% on an annual foundation. Nonetheless, this was considerably above the market consensus forecast, which anticipated a extra substantial slowdown to 2.0%. Thus, it turned out that for the whole yr of 2023, the nation’s financial system grew by 2.5% (in comparison with 1.9% in 2022). The info confirmed the nationwide financial system’s resilience to essentially the most important rate of interest hike cycle for the reason that Nineteen Eighties – as a substitute of the anticipated slowdown, it continues to develop at charges above the historic development (1.8%).

These spectacular outcomes had been a shock for market members. They give the impression of being notably ‘stellar’ in comparison with the efficiency of different forex zones. As an illustration, Japan’s GDP continues to crawl again to pre-COVID-19 pandemic ranges, and the Eurozone’s GDP appears to have been in a state of stagnation for a while. This advantages the greenback, as a secure financial system permits the Federal Reserve to delay the beginning of financial coverage easing and preserve restrictive measures for some time longer. Based on CME futures quotes, the chance of an rate of interest lower in March is presently 47%, nearly half of what was anticipated a month in the past (88%). Many consultants imagine the Fed will begin steadily lowering the price of federal fund loans no sooner than Could or June, ready for indicators confirming the sustainability of the inflation slowdown.

The US Bureau of Labor Statistics additionally reported on January 25 that the variety of preliminary unemployment claims for the week ending January 20 rose to 214K, exceeding the earlier week’s figures and forecasts of 200K. Regardless of the slight improve, the precise worth nonetheless represents one of many lowest ranges for the reason that finish of final yr.

● As talked about earlier, the financial scenario within the Eurozone seems considerably worse, exacerbated by Russia’s navy actions in Ukraine and the downturn of China’s financial system, an vital companion for Europe. Towards this backdrop, the ECB might turn out to be essentially the most hasty among the many G10 central banks to begin lowering rates of interest. Such a step would exert robust strain on the frequent European forex, inserting the euro at an obstacle within the Carry-trade section. Moreover, some great benefits of the greenback as a safe-haven forex shouldn’t be neglected.

● The greenback index DXY discovered robust assist on the 100.00 degree on the finish of final yr, rebounded upwards, and has been consolidating round 103.00 for the previous week, seemingly ‘sticking’ to its 200-day shifting common. Market members are awaiting the Federal Open Market Committee (FOMC) assembly of the US Federal Reserve, scheduled for Wednesday, January 31, amidst robust GDP information and convincing proof of disinflation. It’s doubtless that, as with the ECB, the rate of interest will stay on the present degree (5.50%). Furthermore, Federal Reserve Chair Jerome Powell’s remarks, much like the ECB’s, are anticipated to be cautious relating to the timelines for price cuts. Nonetheless, his extra beneficial tone relating to inflation discount could also be sufficient to revive market confidence at first of financial coverage easing as early as March. On this case, DXY might resume its motion in the direction of 100.00. In any other case, a renewal of the December peak of 104.28 appears fairly believable.

● Information on private consumption expenditures within the US had been launched on the very finish of the workweek, on Friday, January 26. The Core Private Consumption Expenditures (PCE) Value Index confirmed a month-to-month improve from 0.1% to 0.2%, which totally matched forecasts. 12 months-on-year, the index stood at 2.9%, decrease than each the earlier worth (3.2%) and the forecast (3.0%).

These figures didn’t considerably affect the trade charges, and EUR/USD closed the week at 1.0854. At present, nearly all of consultants predict the strengthening of the US greenback within the close to future. Amongst them, 80% voted for the greenback’s appreciation, 0% sided with the euro, and the remaining 20% held a impartial place. Nonetheless, within the month-to-month perspective, the stability of energy between bullish (pink), bearish (inexperienced), and impartial (gray) is evenly distributed: a 3rd for every. Oscillator readings on the D1 timeframe verify the analysts’ forecast: 100% of them are colored pink (15% indicating oversold situations). Amongst development indicators, the stability of energy is 65% in favour of the reds and 35% for the greens. The closest assist ranges for the pair are positioned within the zones 1.0800-1.0820, adopted by 1.0725-1.0740, 1.0620-1.0640, 1.0500-1.0515, and 1.0450. The bulls will encounter resistance within the areas of 1.0905-1.0925, 1.0985-1.1015, 1.1110-1.1140, 1.1230-1.1275, 1.1350, and 1.1475.

● Within the upcoming week, along with the aforementioned FOMC assembly and subsequent press convention, we predict the discharge of This autumn GDP information for Germany and the Eurozone on Tuesday, January 30. On Wednesday, we are going to see the retail gross sales volumes and the Client Value Index (CPI) in Germany, in addition to the state of employment within the US personal sector from ADP. On Thursday, February 1, inflation information (CPI) for the Eurozone and enterprise exercise within the US manufacturing sector (PMI) might be printed. Moreover, on February 1 and a pair of, we are going to historically obtain a wealth of statistics from the US labor market, together with the unemployment price and the variety of new jobs created exterior of the agricultural sector (Non-Farm Payrolls, NFP).

GBP/USD: Inflation Continues to Bolster the Pound

● The retail gross sales report launched on January 19 in the UK turned out to be disappointing. Retail gross sales volumes in December decreased by -3.2% following a 1.4% improve within the earlier month, whereas analysts had anticipated a -0.5% drop. 12 months-on-year, this indicator declined by -2.4% after rising by 0.2% a month earlier (forecast was -1.1%). Gross sales excluding gasoline dropped by -3.3% month-on-month and -2.1% year-on-year, in opposition to knowledgeable forecasts of -0.6% and -1.3%, respectively.

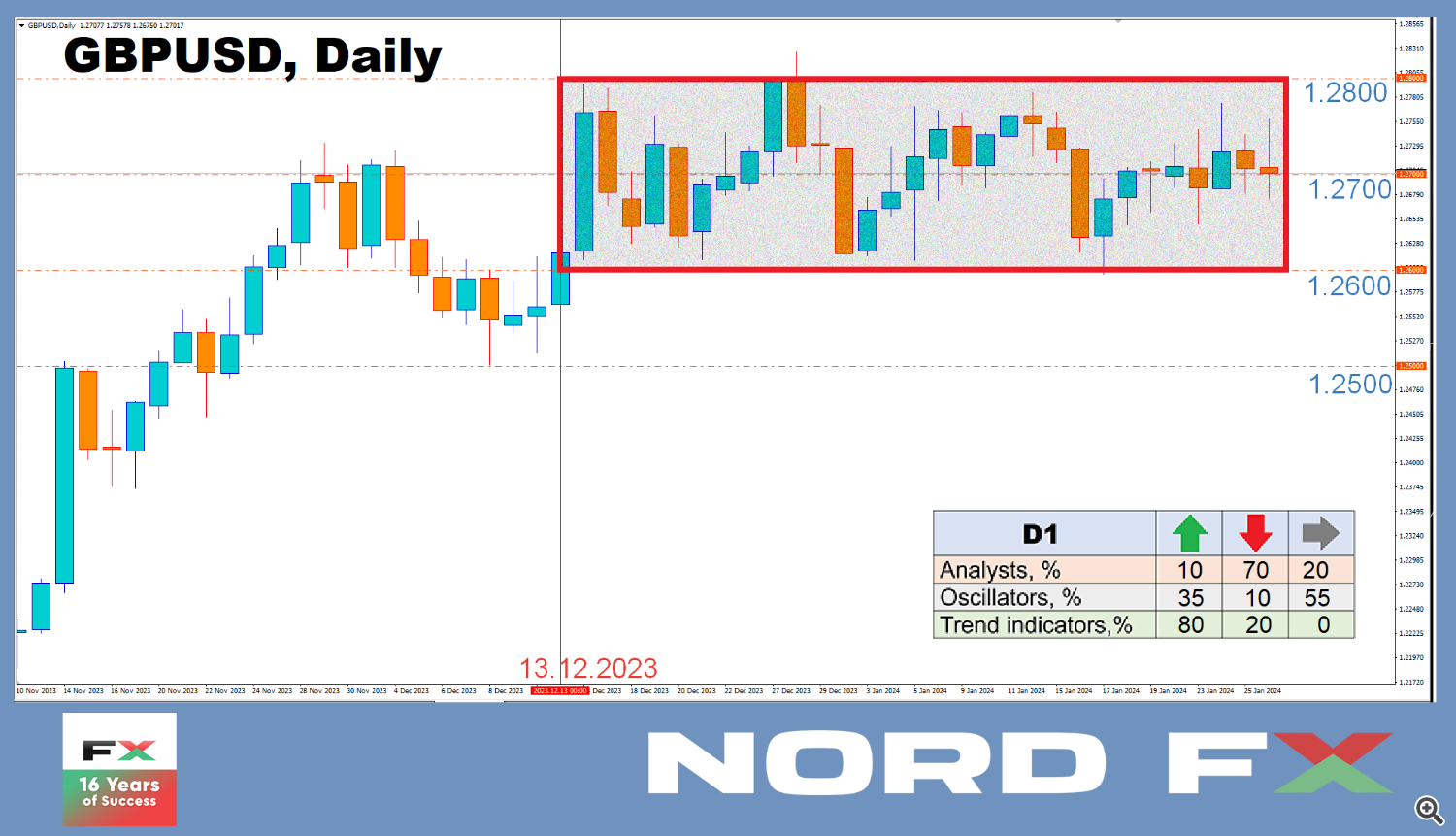

Nonetheless, regardless of this, GBP/USD not solely maintains its place throughout the six-week lateral channel of 1.2600-1.2800 however is even looking for to consolidate in its higher half. Analysts imagine that the British forex continues to be supported by expectations that the Financial institution of England (BoE) will doubtless be among the many final to decrease charges this yr.

● It is value recalling that the December inflation information confirmed the Client Value Index (CPI) in the UK rose month-on-month from -0.2% to 0.4% (consensus forecast was 0.2%), and year-on-year reached 4.0% (in comparison with the earlier worth of three.9% and expectations of three.8%). The core CPI determine remained on the earlier degree of 5.1% year-on-year. Following the discharge of this report, which confirmed rising inflation, UK Prime Minister Rishi Sunak rapidly sought to reassure the markets. He said that the federal government’s financial plan stays sound and continues to work, having diminished inflation from 11% to 4%. Nonetheless, regardless of the Prime Minister’s optimistic assertion, many market members are actually extra satisfied that the Financial institution of England will delay the beginning of easing its financial coverage till the tip of the yr. “Considerations that the disinflation course of might stall have most likely elevated,” Commerzbank economists wrote on the time. “And the market will doubtless guess that the Financial institution of England will reply accordingly and, due to this fact, be extra cautious concerning the timing of the primary rate of interest lower.”

● The British forex was additionally bolstered by preliminary information on enterprise exercise within the nation, launched on Wednesday, January 24. The Manufacturing PMI rose from 46.2 to 47.3, in opposition to a forecast of 46.7. Moreover, the Companies PMI and the Composite PMI firmly established themselves within the development zone (above 50 factors). The Companies PMI elevated from 53.4 to 53.8 (forecast was 53.2), and the Composite PMI went up from 52.1 to 52.5 (forecast was 52.2). From these figures, the market inferred that the nation’s financial system might stand up to excessive rates of interest for an prolonged interval.

● GBP/USD concluded the earlier week at a degree of 1.2701. Relating to the analysts’ forecasts for the approaching days, the sentiment is much like that for EUR/USD: 70% voted for the pair’s decline, solely 10% had been in favor of its rise, and 20% most well-liked to stay impartial. The outlook for the month-to-month and longer-term horizon is extra ambiguous. Among the many development indicators on the D1 timeframe, in distinction to the specialists’ opinions, there is a clear desire for the British forex: 80% point out an increase within the pair, whereas 20% recommend a decline. Amongst oscillators, 35% are in favour of the pound, 10% for the greenback, and the remaining 55% preserve a impartial stance. Ought to the pair transfer southward, assist ranges and zones at 1.2595-1.2610, 1.2500-1.2515, 1.2450, 1.2330, 1.2210, 1.2070-1.2085 await it. In case of an upward motion, the pair will encounter resistance at ranges 1.2750-1.2765, 1.2785-1.2820, 1.2940, 1.3000, and 1.3140-1.3150.

● Along with the FOMC assembly of the US Federal Reserve, we may also have a gathering of the Financial institution of England within the upcoming week. It’s scheduled for Thursday, February 1st, and in line with forecasts, the BoE can be anticipated to maintain the borrowing price on the present degree of 5.25%. Apart from this, no different important occasions associated to the financial system of the UK are anticipated within the close to future.

USD/JPY: Does the Drift In direction of 150.00 Proceed?

● The Client Value Index (CPI) within the Tokyo area unexpectedly dropped from 2.4% to 1.6% in January, and the determine excluding meals and power costs decreased from 3.5% to three.1%. Such a big weakening of inflationary strain may lead the Financial institution of Japan (BoJ) to chorus from tightening financial coverage within the foreseeable future.

This forecast can be supported by the month-to-month financial report of the Japanese authorities, printed on Thursday, January 25. The report states that the results of the robust earthquake on the Noto Peninsula in central Honshu, Japan’s primary island, might scale back the nationwide GDP by 0.5%. These estimates improve the chance that the Financial institution of Japan will preserve its ultra-loose financial coverage no less than till mid-2024. Consequently, any hypothesis about an rate of interest hike in April could be disregarded.

The minutes from the Financial institution of Japan’s December assembly reinforce this outlook. It was famous that the Board members agreed that “it’s essential to patiently preserve an accommodative coverage.” Many members (one other quote) “said that it’s needed to substantiate a constructive wage-inflation cycle to think about the problem of phasing out damaging charges and YCC.” “A number of members stated they don’t see the danger of the Central Financial institution falling not on time and may watch for developments on the annual wage negotiations this spring.” And so forth in the identical vein.

● Economists at MUFG Financial institution in Japan imagine that the present scenario doesn’t hinder the promoting of the yen. “Given our view on the strengthening of the US greenback within the close to time period and the extra significant-than-expected drop in inflation information [in Japan],” they write, “we might even see a rise within the urge for food for Carry-trade positions funded by the yen, which can contribute to the additional rise of USD/JPY.” MUFG strategists opine that the pair will proceed its drift northward, in the direction of 150.00. Nonetheless, because it approaches this degree, the specter of forex interventions by Japanese monetary authorities is anticipated to steadily improve.

Within the curiosity of equity, it needs to be famous that there are nonetheless those that imagine in an imminent shift by the BoJ to a tighter coverage. As an illustration, specialists on the Dutch Rabobank nonetheless adhere to a forecast suggesting the regulator might increase charges as early as April. “Nonetheless,” the financial institution’s consultants write, “every part will rely on robust wage information from the spring negotiations and proof of modifications in company behaviour relating to wages and pricing.” “Our forecast, which sees USD/JPY ending the yr at 135.00, assumes that the Financial institution of Japan will increase charges this yr,” proceed the Rabobank economists. Nonetheless, they add that there’s nonetheless a risk of disappointment within the tempo of price hikes.

● USD/JPY recorded its peak for the previous week at 148.69, ending barely decrease at 148.11. Within the near-term outlook, 30% of consultants anticipate additional strengthening of the greenback, 30% facet with the yen, and 40% maintain a impartial place. Relating to the development indicators and oscillators on the D1 timeframe, all 100% level north, although 10% of them are within the overbought zone. The closest assist degree is positioned within the 146.65-146.85 zone, adopted by 146.00, 145.30, 143.40-143.65, 142.20, 141.50, and 140.25-140.60. Resistance ranges are positioned at 148.55-148.80, 149.85-150.00, 150.80, and 151.70-151.90.

● No important occasions associated to the Japanese financial system are anticipated within the upcoming week.

CRYPTOCURRENCIES: Why Bitcoin Fell

● On January 10, the U.S. Securities and Change Fee (SEC) permitted a batch of all 11 purposes from funding corporations to launch spot exchange-traded funds (ETFs) primarily based on bitcoin. Towards this backdrop, the quotations of the primary cryptocurrency momentarily spiked to $47,787, a degree final seen within the spring of 2022. Nonetheless, as a substitute of the anticipated development, bitcoin then tumbled and recorded a neighborhood minimal of $38,540 on January 23. Thus, in simply 12 days, the cryptocurrency misplaced almost 20% of its worth. Based on a number of specialists, it is a basic case of the “purchase the hearsay, promote the information” state of affairs. Initially, there was a big bull rally fueled by speculations concerning the launch of bitcoin-based ETFs. Now that these funds are operational, market members have begun actively taking earnings.

● Nonetheless, there are different causes for the decline, mirrored in particular figures. The capital influx into BTC-ETFs, lots of which had been launched by main Wall Road gamers like BlackRock, turned out to be smaller than anticipated. It seems that buyers have turn out to be disillusioned with cryptocurrency. Based on CoinShares, the ten new funds had gathered $4.7 billion by the tip of Tuesday. In the meantime, $3.4 billion flowed out of the Grayscale belief, which was thought of the world’s largest bitcoin holder and has now additionally been remodeled right into a BTC-ETF. Logic means that a good portion of the funds doubtless simply shifted from Grayscale buyers to the ten new funds with decrease charges. If that is so, then the online new funding influx is simply $1.3 billion. Furthermore, in current days, this has changed into a internet outflow of $25 million.

It is also vital to notice that for the reason that approval of BTC-ETFs, together with short-term speculators and Grayscale buyers, the sell-off has been influenced by the chapter supervisor of the FTX crypto trade and particularly by miners. Collectively, they’ve unloaded $20 billion value of cash in the marketplace, a big portion of which belongs to the miners. They’re notably involved concerning the rising computational issue and the halving in April, which can power lots of them out of enterprise. Consequently, since January 10, miners have despatched a report 355,000 BTC value $15 billion to crypto exchanges, the very best in six years. In these circumstances, the demand for a spot bitcoin ETF of $4.7 billion (or realistically $1.3 billion) appears modest and unable to compensate for the ensuing outflow of funds. Therefore, we’re witnessing such a big drop within the value of the primary digital asset.

Together with bitcoin, main altcoins, together with Ethereum (ETH), Solana (SOL), Cardano (ADA), Avalanche (AVAX), Dogecoin (DOGE), Binance Coin (BNB), and others, additionally incurred losses. Analysts imagine that the development within the inventory markets has additionally exerted further strain on cryptocurrencies – over the past three weeks, each American and European indices have proven development.

● Peter Schiff, the president of Euro Pacific Capital, didn’t miss the chance to brag over the consumers of bitcoin ETF shares. He believes that the approval of those funds doesn’t create new demand for cryptocurrency. Based on the financier, these buyers who beforehand purchased cryptocurrency on the spot market or invested in shares of mining corporations and Coinbase are actually merely shifting their investments to ETFs. “Shuffling deck chairs will not save the ship from sinking,” predicted this advocate of bodily gold.

Schiff thinks that the destiny of buyers within the spot product might be much like those that invested within the futures ETF BITO, launched within the fall of 2021. At present, shares of this fund are buying and selling at a 50% low cost, implying that bitcoin can be anticipated to fall to round $25,000. Since January 10, 2024, the share value of BTC-ETFs has already fallen by 20% or extra from their peak. The shares of FBTC suffered essentially the most, lowering in worth by 32% in two weeks. “I believe VanEck ought to change the ticker of its ETF from HODL to GTFO [from ‘hold’ to ‘get the heck out’],” Schiff sarcastically commented on the scenario.

● Caroline Mauron, head of OrBit Markets, informed Bloomberg that if bitcoin fails to firmly set up itself above $40,000 quickly, it might set off a large liquidation of positions within the futures market, accompanied by a panic outflow of capital from the crypto sphere.

An analyst utilizing the pseudonym Ali illustrated the value patterns of the final two cycles and, like Caroline Mauron, steered an extra decline within the coin’s worth. The knowledgeable famous that in earlier rallies, bitcoin adopted a constant sample: first reaching the 78.6% Fibonacci degree after which correcting to 50%. Thus, in line with this mannequin, a drop within the BTC/USD pair to $32,700 (50%) is just not dominated out.

Dealer Mikeystrades additionally allowed for a drop to $31,000 and suggested in opposition to opening lengthy positions. “Save your cash till the market begins to reveal bullish power and follows the circulate of orders,” the knowledgeable really useful.

A crypto dealer often known as EliZ predicted a fall within the bitcoin value to $30,000. “I anticipate a bearish distribution over the subsequent two to 3 months, however the second half of 2024 might be really bullish. These stops are essential to preserve the market in a wholesome state,” he said.

● Michael Van De Poppe, founding father of MN Buying and selling, holds a unique view. He emphasised that bitcoin has already collected liquidity and is approaching a neighborhood backside. “Purchase on the lows. Bitcoin under $40,000 is a chance,” the analyst urged. Yann Allemann, co-founder of Glassnode, believes {that a} bullish rally within the bitcoin market will begin within the first half of 2024, with the coin’s worth rising to $120,000 by early July. This forecast is predicated on the dynamics of the asset’s worth modifications up to now after the looks of a bullish flag sample on the chart.

● Certainly, damaging situations shouldn’t be ignored. Nonetheless, it is vital to think about that present pressures are largely on account of short-term components, whereas long-term developments proceed to favor digital gold. As an illustration, for the reason that fall of 2021, there was a rise within the proportion of cash which have remained inactive for over a yr. This indicator is now displaying a report 70%. An rising variety of individuals are trusting bitcoin as a instrument for inflation safety and financial savings. The variety of cryptocurrency customers has reached over half a billion individuals, about 6% of the Earth’s inhabitants. Based on current information, the variety of Ethereum holders has grown from 89 million to 124 million, whereas the variety of bitcoin house owners by the tip of the yr elevated from 222 million to 296 million individuals.

There may be additionally rising acceptance of this new sort of asset amongst giant capital representatives. Final week, Morgan Stanley printed a doc titled “Digital (De)Dollarization?”, authored by the funding financial institution’s COO Andrew Peel. Based on the creator, there’s a clear shift in the direction of lowering dependency on the greenback, concurrently fuelling curiosity in digital currencies akin to bitcoins, stablecoins, and CBDCs. Peel writes that the current surge in curiosity in these belongings might considerably alter the forex panorama. Based on a current Sygnum Financial institution survey, over 80% of institutional buyers imagine that cryptocurrencies already play an vital position within the world monetary trade.

● As of the night of January 26, when this overview was written, BTC/USD is buying and selling round $42,000. The full market capitalization of the crypto market stands at $1.61 trillion, down from $1.64 trillion per week in the past. The Bitcoin Worry & Greed Index stays within the Impartial zone at 49 factors, barely down from 51 per week earlier.

NordFX Analytical Group

Discover: These supplies usually are not funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx