American Categorical is thought for his or her premium bank card providers throughout the globe. For those who’re wanting ahead to expertise essentially the most premium bank card providing from such an elite bank card issuer, you’re on the proper place.

American Categorical Platinum Card which is issued as a “steel” card in India is an Extremely Premium Credit score Card recognized for its premium life-style and journey advantages. It’s a “cost” card, therefore it comes with no pre-set credit score restrict.

Right here’s every thing it is advisable to find out about this prestigious steel card that comes with a standing image,

Overview

| Sort | Extremely Premium Credit score Card |

| Reward Fee | 1.25% – 2.5% |

| Annual Payment | 60,000 INR+GST |

| Finest for | Resort advantages & Concierge providers |

| USP | Resort Memberships |

American Categorical Platinum Cost Card is likely one of the only a few playing cards in India like Axis Reserve, the worth of which needs to be determined primarily based on the approach to life advantages it presents and never simply by wanting on the reward price.

Apply by the above hyperlink & you’ll be rewarded 10,000 Referral Bonus Membership Rewards® factors (spend INR 5,000 inside 90 days) + keep vouchers price INR 45,000* from Taj [Limited Period Offer].

Annual Charges

| Becoming a member of/Annual Payment | Rs.60,000+GST = 70,800 INR |

| Welcome Profit | |

| Renewal Profit | Varies relying on the spends |

| Eligibility | 15L for Self Employed / 25L for Salaried |

With 100K factors one can get a worth >50K INR by transferring them to Marriott Bonvoy, amongst different choices. Whereas solely Taj vouchers can be found as common welcome profit there’s a strategy to nonetheless get 100K factors, extra on that shortly.

Word that, each every so often American Categorical additionally sends focused improve presents for the platinum card with profitable welcome bonus, upto 135K MR factors just like the one we just lately acquired in Jan 2024.

These improve presents are often despatched to present cardholders with good spends. You’re fortunate should you get one.

Credit score Restrict

- Minimal Credit score Restrict: 10 Lakhs

Even-though its a cost card and comes with no-preset restrict, it nonetheless has inside restrict or shadow restrict which is extra like a credit score restrict, besides that it retains rising primarily based in your re-payments.

Normally the restrict begins at north of 10 Lakhs, nonetheless that will probably be often out there to be used solely put up ~3 months of card issuance because the system wants a while to get in step with your spend sample.

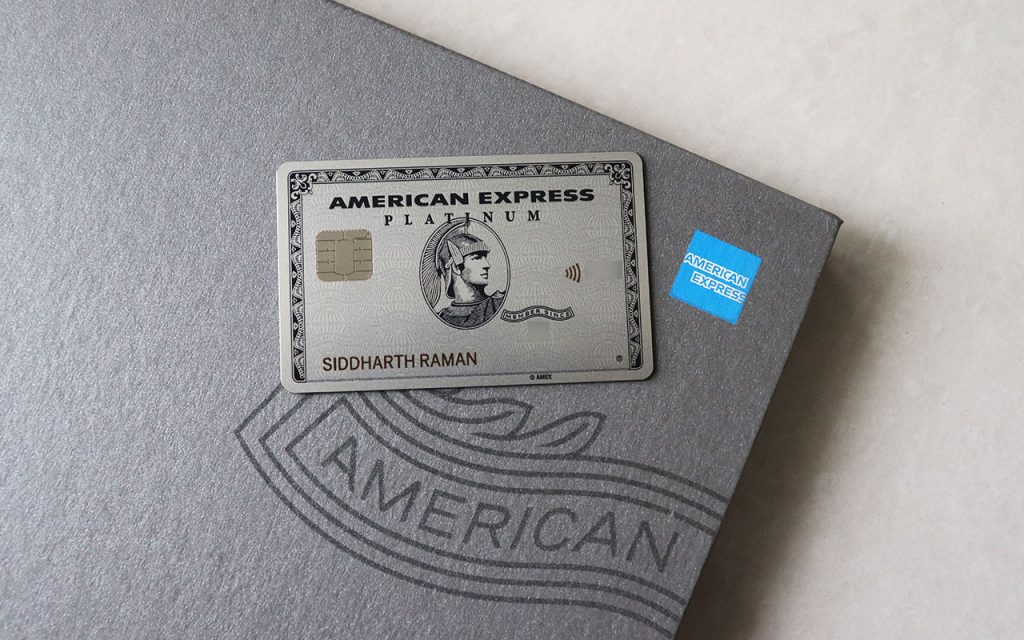

Design

The Amex Platinum Cost Card carries the long-lasting design all around the world with minor modifications to the design components then and there.

In actual life this card gives a real steel really feel that units it aside from different steel bank cards issued in India, because of its genuine metallic color.

Reward Factors

- Earn Fee: 1 MR Level per Rs.40 Spent

- MR Level Worth: ~50Ps to 1Rs

- Reward Fee: 1.25% to 2.5%

The above reward price is calculated primarily based on the “minimal level worth” that one can get with Marriott Bonvoy Factors Redemptions.

For those who’re exploring new properties (or) these situated in not-so touristy/enterprise areas (or) then the worth may very well be within the vary of 1 INR/level.

On high of that, should you’re Marriott Bonvoy Platinum or above, you additionally get breakfast & lounge entry, which modifications the sport altogether.

Redemptions

Whereas there are very some ways to redeem Amex MR factors, I’ve personally redeemed them largely for Marriott.

I’ve acquired a worth of nicely over 1 INR / level at instances, like my latest redemption on the stunning Westin, Himalayas as you may see under:

However more often than not I’ve acquired 1 INR / level like these at JW Marriott Status Golfshire, Bangalore (or) Sheraton Grand, Mahabalipuram and its robust to place a static worth on it as even the above retains altering.

That mentioned, most Platinum cardholders switch the factors to Marriott to extract most worth out of them, as you may as nicely switch MB factors additional to Airways and get a greater worth by airmiles, amongst which United is sort of common.

Foreign exchange Spends

- Foreign exchange Markup Payment: 3.5%+GST = 4.13%

- Reward price on Intl. Spends: 3.75% – 7.5% (3X rewards)

- Internet achieve: ~3.3% (provided that you will get 1 INR per 1 MR)

It’s an honest bank card for worldwide transactions as you achieve over 3% of the spend. Nonetheless, that is solely for many who can extract a worth of 1 MR = 1 INR as talked about in above examples.

It’s not for everybody! I personally want to make use of different playing cards for worldwide transactions except the service provider is new & of low profile.

Having mentioned that, contemplating the peace of thoughts that Amex provides you with their Zero misplaced Card legal responsibility, it possibly higher to swipe Amex over different playing cards when in international land.

Airport Lounge entry

| Lounge Sort | Entry Restrict |

|---|---|

| Home Lounges | Limitless |

| Amex Lounges | Limitless |

| Precedence Go Lounges | Limitless |

| Delta Lounges | Limitless |

- Home Lounges: Each major and supplementary card holders get limitless lounge entry to many of the home airport lounges situated in India. These are affiliated lounges and never owned by Amex.

- Amex Lounges: You get limitless lounge entry to the Amex lounges throughout the globe like Mumbai Amex Lounge. You additionally get entry to the Centurion lounges throughout the globe.

- Precedence Go Lounges: You get limitless entry to the 1200+ precedence go lounges throughout the globe. Word that solely one supplementary cardholder could be enrolled for precedence go lounge entry profit.

- Delta Lounges: Other than the common lounges, the extra benefit of this card is, you may also entry Delta lounges whenever you fly with Delta Airways. This will come useful should you’re flying inside USA.

Word: You could must request for a Precedence Go after getting the cardboard. Nonetheless, I used to be advised {that a} digital precedence go will probably be out there immediately, if required.

Birthday Profit

Since 2021 American Categorical has been sending out 10K Taj voucher on the cardmember’s birthday. This can be a great profit which I’ve been having fun with since previous 3 years.

The voucher is distributed a month previous to the birthday month, ideally despatched by the tip of the earlier month.

Journey Spend Profit

- Spend 1L on Worldwide journey and get 15,000 INR Taj Voucher

This journey profit is relevant yearly they usually hold shifting it between 30K/15K vouchers on occasion. Fairly profitable for these doing income journey spends on playing cards.

Resort Elite Tier Advantages

The American Categorical Platinum Cost Card provides you grand set of elite tier advantages that you may get pleasure from so long as you maintain the platinum card. To avail the tier advantages,

- Login to your Amex a/c

- Go to this URL

- Signup for respective advantages

| Resort Loyalty Program | Tier | Worth |

|---|---|---|

| Marriott Bonvoy | Gold | ~ 20,000 INR |

| Hilton Honors | Gold | ~ 20,000 INR |

| Radisson Rewards | Premium | – |

| Taj Epicure | – | – |

Marriott Bonvoy (Gold):

That is an important profit that you may get with the platinum card. The mixture of Gold Elite standing & 100K welcome bonus factors makes this card extremely invaluable.

Contemplating you keep 10 nights a yr with 5 profitable upgrades, you will get minimal of 20K INR worth out of Marriott Gold tier however there are various who may get greater than 50K INR a yr simply with this single profit.

I get pleasure from this profit very often as you may see it on my Marriott resort evaluations. This often will get me upgrades, breakfast and few different advantages.

Hilton Honours (Gold):

That is yet one more wonderful resort loyalty program which I just lately explored at Austria & Eire. The complimentary breakfast profit has worth particularly in nations like Europe the place the breakfast price is definitely like 50 EUR for 2.

For those who do 5 nights a yr, you may simply recover from Rs.20k worth with breakfast profit alone. For those who put a worth on upgrades, then you might save far more.

Taj Epicure:

It’s often useful for many who avail the Spa and Salon providers at Taj properties because the providers are discounted at 20% on the invoice.

The improved model of Taj Epicure membership now in 2024 additionally provides you 1 birthday cake & 2 entry to the Taj Membership Lounges which alone is nicely price of over 5K INR.

Radisson Rewards

For those who’re somebody who’s already loyal to Radisson it does aid you with room upgrades & extra.

The gold tier helped me to request for an improve at Radisson Blu Guwahati however nicely nobody cared concerning the tier at Radisson Blu Bangalore Outer Ring Street, so all of it relies upon.

Golf Advantages

- Complimentary Video games: 4 per 30 days

- Complimentary Classes: 2 per 30 days

Get pleasure from complimentary video games and classes throughout 30+ home Golf Programs in India. Limiting classes to 2 per 30 days together with many different restrictions is definitely not so good for a card that prices this excessive.

Eating Advantages

- EazyDiner Prime

- Taj Epicure

Eazydiner Prime is a strong profit to have certainly because it may assist us save ~45% on the invoice simply when coupled with PayEazy presents.

Platinum Concierge

American Categorical Concierge service is likely one of the most under-rated and under-utilized profit on this card.

Nope, you don’t want to make use of it for gathering sand from the ocean. It will also be used for all of the common day-to-day wants. However the brand new problem is that we have to name them for all requests, beforehand they used to deal with over electronic mail which was so useful for me.

Amex Concierge Service is broadly divided into journey & life-style. Extra concerning the respective providers right here:

Journey Concierge

Usually all concierge requests associated to journey goes by this crew. The providers consists of however not restricted to:

- Visa Companies

- Journey Itinerary Planning

- Complimentary First Class Improve on Etihad

Way of life Concierge

They will do just about something beneath the solar with their Do-Something Platinum Concierge. Typically you want a life-style of its personal to get worth out of it.

Nonetheless, you may also use them to delegate small duties that would prevent time. That’s how I exploit them.

My Concierge expertise: I’ve despatched them over 100 requests in final 3 years and what I’ve seen is that they under-perform throughout peak journey season.

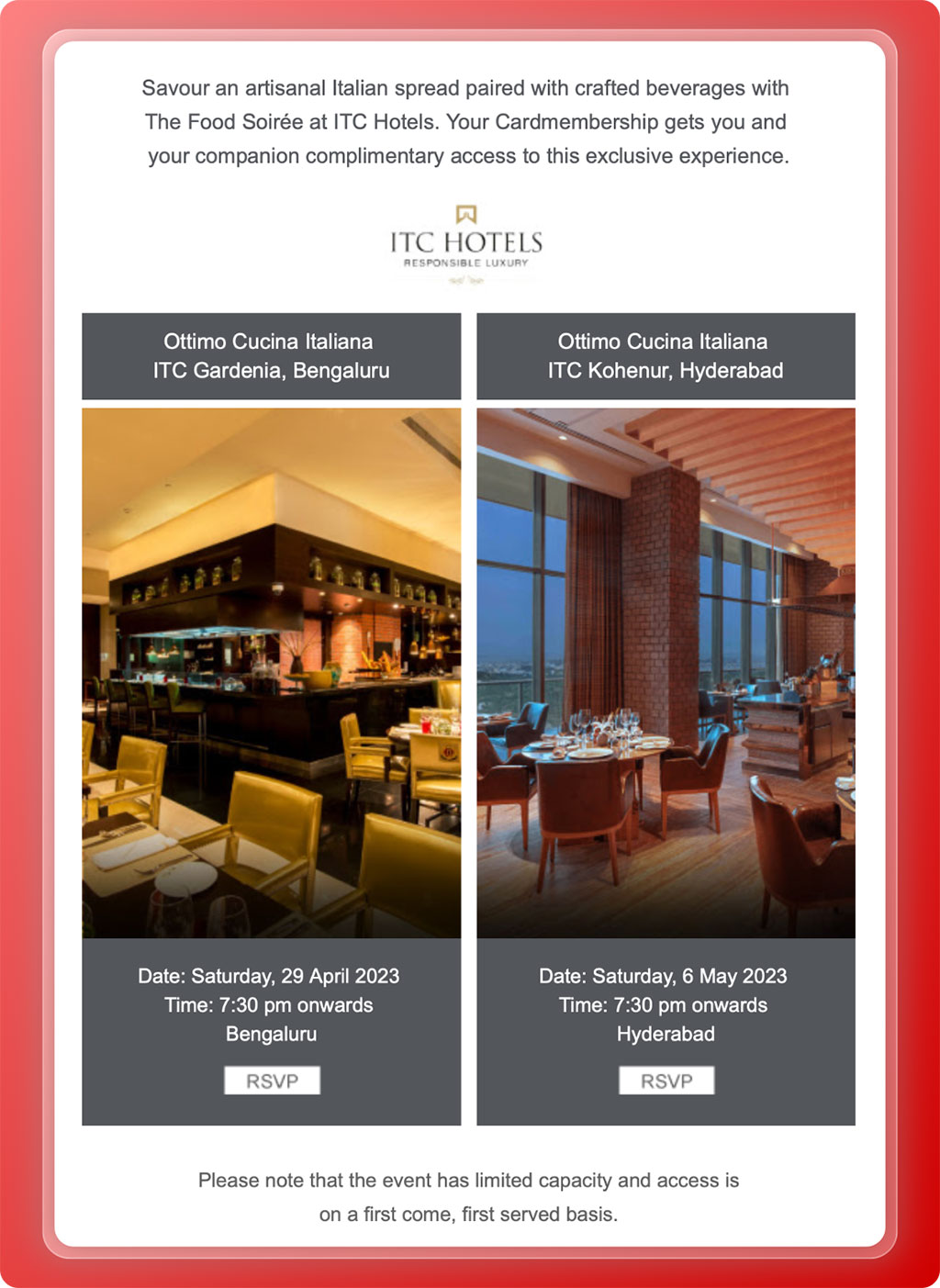

American Categorical Invitations®

A singular programme that provides Platinum Cardmembers an opportunity to buy tickets to a number of the hottest occasions, typically earlier than they go on sale to most of the people.

Other than this, Amex additionally sometimes invite the cardmember+1 for a “complimentary meal” at ITC/Taj inns situated in metro cities. Right here’s the latest one:

These type of eating experiences are nice, besides that I want that they might do it extra typically and in additional cities.

Airport Quick Monitor

American Categorical Platinum playing cards issued in sure nations comes with the power to entry the quick observe safety lanes in respective nations and happily this is applicable to all American Categorical Platinum playing cards issued globally as nicely.

For those who’re on this profit, do try the Amex touchdown pages in these respective nations: Amex Canada, Amex Italy, Amex Sweden. This profit can be relevant at Austria & Belgium airports.

That’s not an amazing protection certainly however should you’re flying to those nations, it’s price figuring out.

Companion card

With Amex Platinum, you may select one of many different Amex bank cards as a companion card which stays free for all times so long as you maintain the Platinum Card.

Normally Amex Reserve is given as a companion card however if you need to maximise the worth, Amex Platinum Journey card is the most effective one (assuming you want plat journey card advantages).

Supplementary Playing cards

- 4 Supplementary playing cards

- 1 extra card for Enterprise Bills

You possibly can rise up to 4 supplementary playing cards, that are additionally steel playing cards together with your American Categorical Platinum cost card.

Supplementary card holders also can get pleasure from many of the above advantages {that a} major cardholder enjoys, together with the resort privileges.

Don’t overlook to use supplementary playing cards throughout the provide interval as they run some great presents like: you will get Rs.1000 – Rs.2000 Amazon Voucher per Supp. Card on the Platinum Card.

Unboxing

I’ve unboxed 2 Amex Platinum playing cards, one in 2019 (supp. card) and the opposite in 2020 (major card). Be at liberty to take a look at each the hyperlinks for the detailed unboxing. The packaging stays the identical even now in 2024 as nicely.

Renewal

The welcome profit for the primary yr takes care of the charge certainly. However from 2nd yr onwards, it is determined by the renewal/retention give you obtain.

As of early 2024, the retention profit on Plat Cost with average spends of 5-10L a yr can get retention profit wherever between 30K Taj vouchers to 80K MR factors however of-course with larger spends there may very well be even a greater provide.

Is it Price 70,800 INR?

So now we’re coming to the tough query!

Tough as a result of I’ve spoken to over 50+ Amex Platinum Cardholders prior to now 7 years throughout my bank card session classes and every one has their very own motive to carry on to the cardboard as a result of it has given them memorable “experiences”.

Whereas we are able to’t put a worth on these experiences because it’s totally different for every, let’s see what the cardboard can provide with it’s major advantages.

Let’s analyse the overall worth of the cardboard by putting an “common” worth on every of the profit we noticed above. Right here we go,

| BENEFIT | DESCRIPTION | VALUE (INR) |

|---|---|---|

| Welcome profit | 45K Taj Voucher | 45,000 |

| Birthday profit | 10K Taj Voucher | 10,000 |

| Marriott Bonvoy Gold | 20K INR worth | 20,000 |

| Whole | 75,000 |

- Whole Worth: 75,000 INR + Lounge + Golf + Concierge

So that you get bit greater than what you pay, assuming you make use of the Marriott Bonvoy Gold profit (or Hilton for that matter) simply as most different card holders do.

Journey spend profit can be one other profitable profit to take a look at.

After which should you play golf 10 instances (or) use lounge 10 instances (or) avail concierge providers typically, that’s one other 20K INR financial savings simply for “every” of the providers talked about.

For those who avail all these providers, then the general worth you get is large!

To sweeten this deal, you may also get one other 10K Referral Bonus Factors by making use of by the hyperlink under. That’s 5K INR worth (or) one further evening at choose Marriott inns!

Apply by the above hyperlink & you’ll be rewarded 10,000 Referral Bonus Membership Rewards® factors (spend INR 5,000 inside 90 days) + keep vouchers price INR 45,000* from Taj [Limited Period Offer].

Bottomline

Total, it’s a pleasant card for somebody who loves luxurious experiences in life. The draw back is that the becoming a member of profit proven publicly is restricted to Taj Vouchers, which not everybody would really like.

Nonetheless, do notice that you could be request for 100K factors as a substitute of 45K Taj voucher after receiving the cardboard just by calling the help. They “largely” approve such requests from what I’ve seen. However do not forget that it needs to be finished earlier than activating the cardboard.

That apart, it’s not solely a card for you, but in addition for your complete household, as chances are you’ll share 4 supplementary playing cards with your loved ones & buddies so that they can also get pleasure from virtually all the advantages as you do.

So should you love Amex and need to expertise this steel at-least as soon as, then nothing gonna cease you from getting it. Benefit from the Platinum Life!

What’s your tackle the American Categorical Platinum Cost card? Be at liberty to share your ideas within the feedback under.